Outlook • May 8, 2025

California’s Regulations Play a Role in Agriculture’s Export Gap

Rural Economist: Spring 2025 | Theme 1

Key points:

- Representing more than 20% of U.S. agricultural exports, California stands to benefit from efforts to narrow the trade gap.

- The rising cost of regulations and labor is a significant disincentive to investing in expanded production for export.

The net export gap has become a significant focus, with the most attention on the loss of U.S. manufacturing. However, the agricultural sector also became a net importer in 2022.

To narrow the agricultural export gap, California must be the central focus. It represents more than 20% of exports. However, high production costs, particularly due to regulations and labor, are likely to hinder this resurgence.

Water costs in California, especially in the Central Valley, have experienced significant volatility, with prices increasing from $266 per acre-foot in 2013 to $961 in 2022, and now down to roughly $400 due to heavier snowpack. Price volatility and environmental constraints are likely to drive future costs higher.

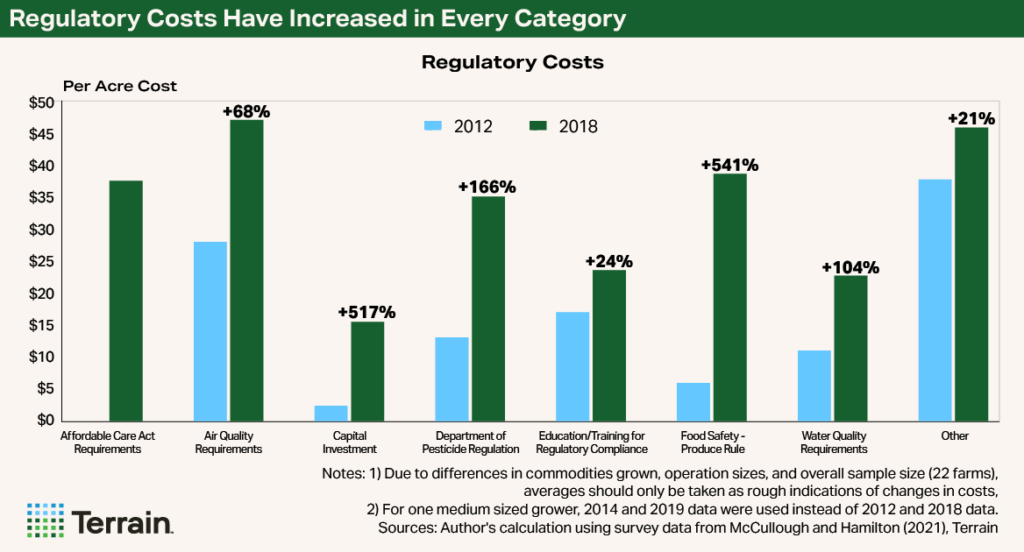

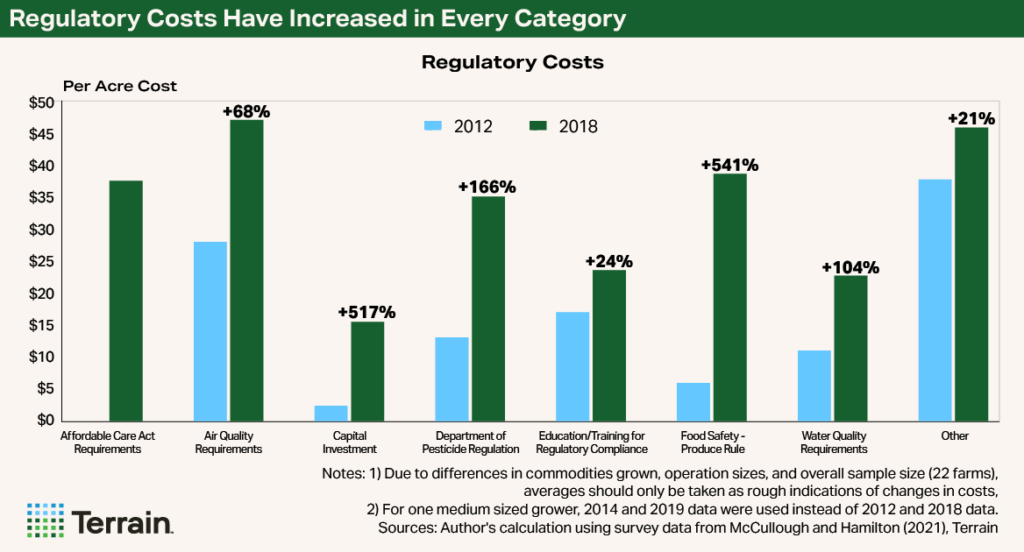

Regulatory compliance is a significant cost increase that affects nearly every aspect of farm operations.

Labor costs also have surged, with minimum wage increases and a shrinking labor pool, making it harder for producers to attract workers despite higher wages. In California, the Adverse Effect Wage Rate for the H-2A visa program has nearly doubled over the last decade, rising to $19.97 per hour in 2025 for field crop and livestock workers.

Regulatory compliance is a significant cost increase that affects nearly every aspect of farm operations. A study by McCullough and Hamilton (2021) sheds light on this issue by surveying 22 farms of various sizes in the Central Valley in 2012 and 2018 to assess changes in regulatory costs. Despite the small sample size, the study reveals a substantial increase in regulatory costs over the six-year period, with larger farms experiencing the most significant rise due to specific requirements for operations employing a certain number of workers. The following categories make up the highest percentage increases:

- Food safety

- Capital investments related to regulatory compliance (such as reporting software)

- Pesticide application costs

On a per-acre basis, regulatory costs have increased by $38 for the Affordable Care Act (costs were zero in 2012), $33 for food safety, $22 for the Department of Pesticide Regulation, $19 for air quality requirements, $13 for regulation-induced capital investments, $12 for water quality requirements, $7 for labor-related requirements, and $6 for regulatory-related education and training.

Importantly, the observed increase in regulatory costs by McCullough and Hamilton are nearly a decade old, suggesting that regulatory costs are likely much higher today for California farmers and ranchers – further straining their farm financial conditions. At the time of the 2018 survey, only a few farms had Sustainable Groundwater Management Act assessments, and new regulations like California’s recent emissions reporting laws (the Climate Corporate Data Accountability Act (SB 253) and the Climate-Related Financial Risk Act (SB 261)) suggest there will be further increases in regulatory costs. As costs rise, specialty crop growers are concerned about their operations' viability.

Bottom line: The national political environment is clearly in favor of expanding domestic agricultural production, particularly in specialty crops, and in some cases, like fresh market tomatoes, limiting agricultural imports. This may benefit California agriculture; however, water, labor and regulatory compliance costs are expected to continue to increase for California farmers. Therefore, the ability for California farmers to be cost competitive enough to significantly expand their operations, limit imports and expand exports is very unlikely without a considerable reduction in their regulatory burdens. Investment opportunities in these sectors should weigh the regulatory cost heavily.

This article is part of The Rural Economist, a report that brings forward the trends that will impact agricultural investments tomorrow.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.