Report Snapshot

Situation

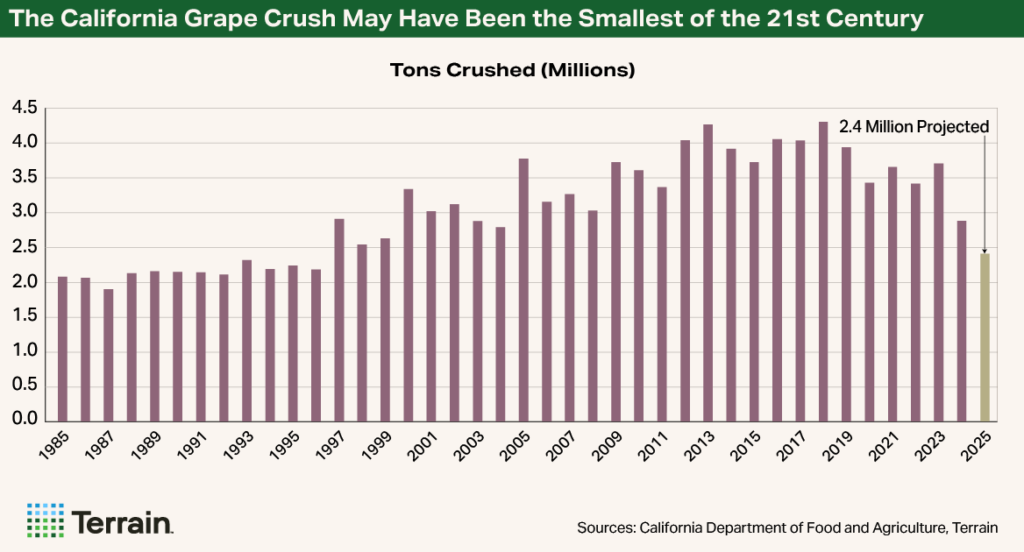

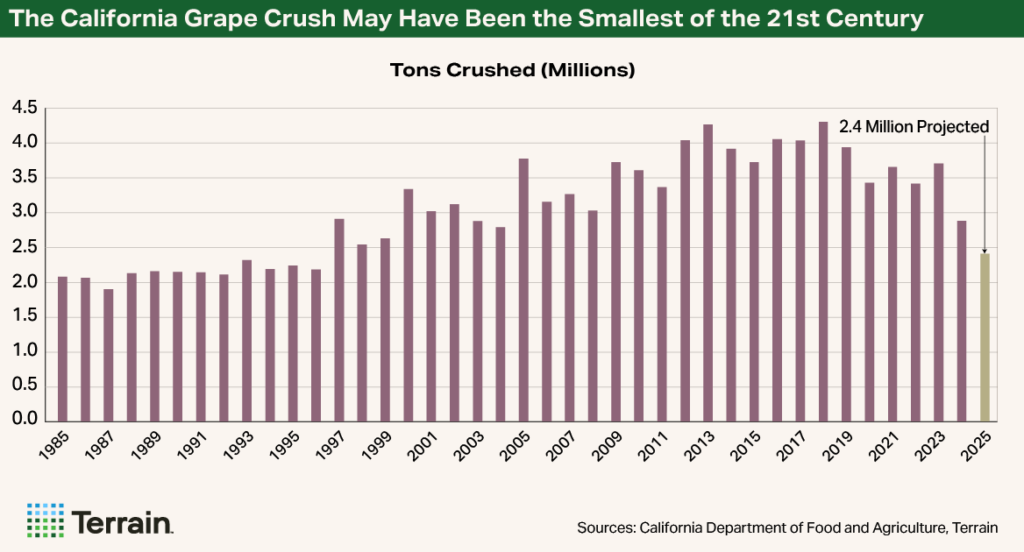

Challenging growing conditions, vineyard removals, and a dearth of demand contributed to a 2025 California grape crush that will likely turn out to be the smallest in at least 25 years.

Outlook

To the extent that the wine sales slump has been driven by the economy, there is not likely to be much improvement in the near term. However, there could be some progress in the grape market, as the small crush will help to reduce excess wine inventory and vineyard removals will bring supply into closer alignment with demand.

There was no material change in the complexion of the wine market in the third quarter of 2025. Wine sales continued to decline across all channels and price points, though at varying rates. The 2025 grape crush is likely to have been the smallest in at least a quarter-century because of a reduction in bearing acreage and a dearth of demand for grapes.

I’m not expecting much improvement in wine sales in the near term because of a sluggish economic backdrop. However, there could be some progress in the grape market, as the small crush in 2025 will help to reduce excess wine inventory and vineyard removals will bring supply into closer alignment with demand.

As Wine Sales Fall, $15 Is the Sweet Spot

Based on my analysis of NIQ data, off-premise wine sales fell 5% year over year (YOY) in both value and volume in the third quarter. The decline was a bit steeper than in the second quarter but shallower than in the first. According to SipSource data, third-quarter depletions fell 7% YOY in terms of revenue and 10% YOY by volume, a steeper decline than in the first six months of the year.

The three-tier market remains distinctly bifurcated at the $15 price mark.

Sales of wines priced at $15 and above are down just 1% in volume in NIQ outlets year to date — a slightly better performance than in 2024 — though they have deteriorated a bit in value. Conversely, sales of brands priced below $15 were off 6% in both value and volume during the first nine months of 2025, a weaker reading relative to 2024.

Direct-to-consumer (DtC) sales are clearly still fading, though the datapoints send mixed signals regarding the magnitude.

Community Benchmark’s DtC sales figures for the first nine months of 2025 are slightly worse than the full-year figures for 2024. They also indicate that visitor counts are still declining across the West Coast. The erosion in sales and visitor counts is likely attributable in part to consumer pushback against rising costs.

To the extent that the wine sales slump has been driven by the economy, there is not likely to be much improvement in the near term.

We don’t yet have a full account of wine exports in the third quarter because of the government shutdown. However, based on the first two months of the quarter, there doesn’t look to have been much improvement.

To the extent that the wine sales slump has been driven by the economy, there is not likely to be much improvement in the near term, as I expect slightly below-average growth, inflation to remain above target, and consumer pessimism to persist. The fourth-quarter retail wine sales figures will likely be weak because of a strong year-ago comparison. The premium and luxury segments should continue to outperform.

A Small Crush Is a Silver Lining

Challenging growing conditions, vineyard removals, and a dearth of demand contributed to a 2025 California grape crush that will likely turn out to be the smallest in at least 25 years. Industry experts expect the harvest to come in below 2.5 million tons, and perhaps well below. This compares with 2.9 million tons last year and an average of 4 million during the mid-2010s.

I believe more grapes will be needed in 2026 than were taken in 2025.

The grape glut ultimately traces back to declining wine sales, as declining wine sales imply demand for fewer grapes. The slump in consumption has also created a wine inventory glut. Thus, fewer grapes were needed in 2025.

There is a silver lining: The small 2025 harvest will help to reduce the wine inventory overhang. Thus, I believe more grapes will be needed in 2026 than were taken in 2025, though this will depend on the final size of the 2025 crush and path of wine sales.

The potential for improvement in grape demand coupled with further vineyard pullouts sets the stage for a more balanced grape market in 2026.

Progress has also been made on the supply side. The California Association of Winegrape Growers indicates that 38,000 acres of wine grapes were removed between October 1, 2024, and August 1, 2025, a 7.5% reduction. This comes on top of heavy removals the prior year. More acreage is likely to be removed in the coming months as growers without contracts throw in the towel.

The potential for improvement in grape demand coupled with further vineyard pullouts sets the stage for a more balanced grape market in 2026, though prospects for price improvement remain subdued. As always, supply and demand dynamics will vary widely across appellations, varieties and quality tiers.

Growers should continue to monitor the market data closely. We’ll have a better sense of the situation as fresh data arrive over the coming months on 2025 crush size, vineyard removals, wine sales and more.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.