Wrangling Interest Rates in 2024

Article Originally Published in the March 2024 Issue of the National Cattlemen

By Matt Clark, Senior Rural Economy Analyst

For most cattle producers, 2023 was an excellent fiscal year. Cattle prices remained strong, feed costs moderated and drought started to recede. There was, however, a fly in the ointment for many ranchers: the cost of interest.

In the fourth quarter of 2023, variable interest rates for cattle loans were at their highest point since 2006, according to the Federal Reserve Bank of Dallas. My Terrain colleague Dave Weaber estimated that the current interest rate environment has increased the cost of ownership of various classes of cattle since just the beginning of 2022. Specifically, interest costs have risen:

- $74 per head for bred heifers

- $41 per head for 800-pound feeders

- $26 per head for 500-pound stockers

The higher cost of interest, alongside general inflation, has dulled what could otherwise be stronger bullishness for many ranchers considering herd expansion, land acquisition, feeding facility expansion and larger feeder lines of credit.

The Rate Cut Question

In January 2024, the Federal Reserve kept the federal funds rate — a benchmark that influences nearly all interest rates — steady for the fourth consecutive meeting but left the door open to future interest rate cuts.

Fed President Jay Powell reiterated in the January press conference that inflation will need to consistently moderate toward the central bank’s stated 2% goal to realize the expected rate cuts. Exactly how much and how long inflation needs to moderate is a mystery within the trade.

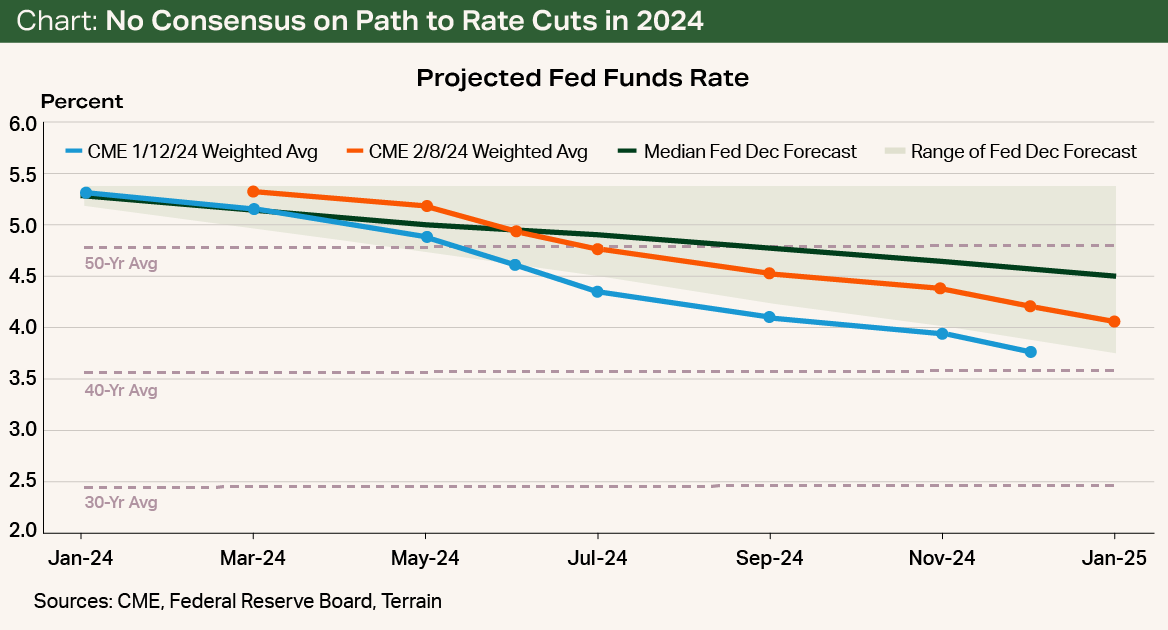

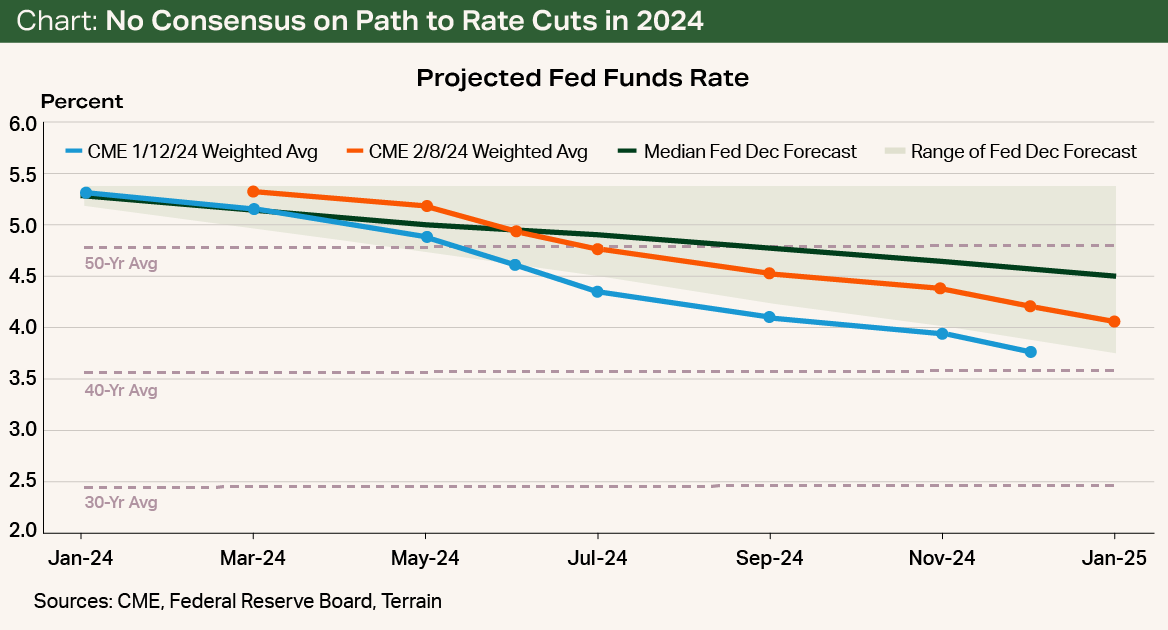

Members of the Fed and the futures market seem to agree that there will be rate cuts in 2024, but there is a wide range of opinion on how aggressive those cuts will be (see Chart).

It Will All Come Down to the Data

Both the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) inflation estimates remain well above 2% on a year-over-year basis; however, most measures of the CPI and PCE on a six-month and three-month annualized basis are below 2%. Individual components within these inflation baskets have been much slower to readjust down, such as rent and wages. Those two components are important to Fed officials.

I believe that the Fed is very cognizant of the potential ramifications of a reacceleration of inflation, even if the probability of reacceleration is minimal. Recent signals have reinforced inflation behavior and the Fed’s decision to keep rates steady in the near term:

- The very strong labor market, with a 3.7% headline unemployment rate

- Well above-trend GDP growth in the third and fourth quarter of 2023

If the labor market and economic growth remain strong, the Fed is likely to lower interest rates at a much slower pace than the market currently estimates — closer to its own forecast in December of 75 basis points of cuts in 2024.

However, the Fed could start the process of normalizing rates at a quicker clip if the next several months of inflation data confirm that inflation risks have been properly beaten down and/or the labor market and economic growth show signs of weakness.

Know Your Options, and Opportunities, in 2024

For ranchers considering larger investments in land, equipment, facilities or herd expansions, interest rates are likely to remain elevated in the near future. Remain in communication with your Farm Credit lender to fully understand different loan products and pricing options so you are prepared to execute on your opportunities in 2024. If you acquired significant cash in 2023, work with your lender to maximize your cash returns while maintaining your desired level of flexibility for future investments and opportunities.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.